After the successful numbers released by the different Latin American industry the previous year, especially in what has to do with the compressor segment, 2011 is presented as a year in which there is confidence, but at the same time there is an air of restraint for what will be the behavior of its business partners.

After the successful numbers released by the different Latin American industry the previous year, especially in what has to do with the compressor segment, 2011 is presented as a year in which there is confidence, but at the same time there is an air of restraint for what will be the behavior of its business partners.

By Santiago Jaramillo H.

It is no secret that a good part of the economic results of the countries of Latin America are subject to the behavior of their main trading partners, the developed countries, that is why the importance of creating strategies that are prone to maintain the commercial balance with them and, at the same time, generate strategies that allow the industries of the area to target emerging economies, which provide interesting business opportunities.

According to a United Nations report, the Economy of Latin America would reduce its speed of expansion during the present and next year due to a moderation of trade flows that go to the region, mainly to Mexico and some Central American countries.

In this sense, Latin America would grow by 4.1% in 2011 and 4.3% next year, from the 5.6% expansion estimated in 2010, says the UN report on the situation and prospects of the world economy.

According to the same report, the risks to exports will be most palpable in the economies of Mexico and Central America, where dependence on manufacturing exports to the United States is greater, as well as competition from China.

Brazil, the region's largest economy, is expected to grow by 4.5% and 5.2% in 2011 and 2012, respectively, from a powerful 7.6% expansion in 2010.

In the case of the region's second-largest economy, Mexico, GDP would rise to 3.4% and 3.5% in 2011 and 2012, compared to an estimated 5% in 2010.

For developed economies, the United Nations estimates an expansion of 1.9% in 2011, from the 2.3% estimated for 2010.

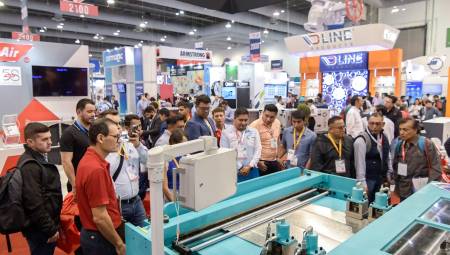

This borders on the good figures that the refrigeration industry showed last year and its prospects, which thanks to the dynamics presented in 2010 can speak, in many cases, of increases not less than double digits in their businesses.

A concrete example of this is evident in the compressor segment, which in the case of countries such as Mexico, Brazil, Colombia and Argentina, managed to consolidate and exceed the expectation that had been estimated at the beginning of 2010 by the industry.

According to the data and statistical system Datamyne, Mexico achieved an increase in its compressor exports that reached 24% in the value of sales; Brazil, on the other hand, exceeded 25%, Argentina reached an increase of 14% and Colombia reached an encouraging 49% increase in its business.

The percentage of devices placed on the international market through its exports also exceeded all expectations and left in the spotlight a panorama that any company would like to have on its balance sheets.

The case of the Mexican compressor industry managed to put in the international market 23% more products than in 2009, Brazil also exceeded the expectation and increased the number of units by 22%, meanwhile, Colombia, put a high rung in the ranking, after increasing its business by 65% more units sold.

The main trading partners of these countries definitely remain the United States, Central America and some South American nations.

Colombia has Brazil, Ecuador and Venezuela as its main trading partners; Mexico, for its part, has in the United States, Colombia and Costa Rica its strongest allies; Argentina figures its best sales in Brazil and China; while Brazil has its main buyers in the United States, Mexico and Argentina.

On this behavior, Germán G. Flórez, Vice President of the International Division of National Compressor Exchange, Inc., states that "2010, from our point of view, was a year where compressor consumers in the industry of the Latin American market and the whole world, driven by the decline in economic activity, made leaps and bounds in the understanding that a compressor remanufactured under the strictest measures and demands, it can compete and in the same way, thus meeting the expectations and demands typically expected of an original product or OEM."

He also said that "the focus on quality, good product performance, compatibility with the demands of the industry in favor of the environment and energy savings, have been key in the growth of the business and the company."

Meanwhile, Gerardo Martínez, representative of Bitzer Mexico, said that 2010 left good results, and that "the cold chain for the preservation of food, from cooling or freezing, refrigerated transport and conservation (storage), gave the greatest boost to the refrigeration industry."

A good year for imports

With regard to their imports, Argentina, Colombia, Mexico and Brazil also significantly increased their purchase figures.

Colombia did business in 2010 for more than FOB US$51 million, having its main suppliers to Brazil, Mexico and South Korea. In 2009 the business reached FOB US$34 million.

Mexico also had a notable increase from FOB US$410 million in 2009 to more than FOB US$544 million last year. Its most important trading partners remained the United States, Brazil and Singapore.

The case of Argentina, which had its main suppliers in Brazil, China and Japan, is also very positive as it increased its business from FOB US$122 million in 2009 to almost FOB US$200 million in 2010.

Brazil also significantly increased its purchases, more than FOB US$100 million, after having purchases for FOB US$122 million in 2009 and increasing to FOB US$267 million in 2010.

After the statistics presented by the data and statistical system Datamyne and the opinion of our guests, it can be inferred that although trade dependence with developed economies is still high, in the case of the United States, many of the members of this economic community, especially with regard to the refrigeration industry, and more specifically with the issue of compressors, they have chosen to diversify their fronts of commercial interest, therefore, despite the figures proposed by the United Nations, the expectations for 2011 are high.