By Julián Arcila

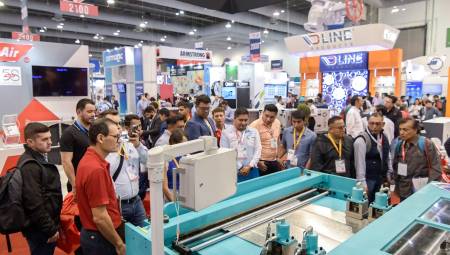

Components for refrigeration and AC during 2006

2006 was a very positive year for Latin America in terms of economic performance. After the bad signs of 2000, a year in which several of the region's economies were emerging from a severe recession and others were just entering, 2006 was the fourth consecutive year in which regional economies showed growth, something that was driven by a general rebound in the global economy, but also by the increase in the prices of raw materials, a situation that has calmed down in some aspects, but that even in 2007 had impressive peaks with the barrel of oil close to US $ 100.

But to describe the economic moment of 2006, suffice it to say that this was the best year in decades in economic terms. It was a record year in terms of exports and some countries presented exorbitant growth, such was the case of Venezuela (10%), the great beneficiary of the rise in crude oil prices; Cuba (12.5%), Argentina (8.5%), Panama (7.5%) and Peru (7.2%) Fig. 1. Panama thus confirms the comments of many experts that it is perhaps one of the most attractive markets for the air conditioning segment, which is consistent with the high growth that has been observed in its construction industry.

Likewise, 2006 marked a precedent in the sense that it was the year in which the rise in trade between the region and the large emerging economies, such as China and India, began.

However, the important thing is to calculate what impact this economic environment had on the CVAC/R industry. For the above, AC/R LATINOAMÉRICA consulted five companies on the performance of business in the region; they were: Honeywell (controls and refrigerants), Full Gauge (controls), Heatcraft do Brasil (evaporators and condensers for refrigeration systems), Danfoss (Compressors for A/C and refrigeration) and Bitzer (compressors for refrigeration).

Market characteristics

General perception

Based on the answers provided by the companies and officials interviewed, it can be said that the Latin American market showed significant growth in each of the segments related in this analysis. Each sector presented particularities that are outlined below.

•The commercial refrigeration sector had significant growth during 2006.

•In the refrigerant gases segment, 2006 meant a year for regularization, after supply problems of a key product such as the 134th. Work began to encourage the replacement of the R-12. The negative factor was the entry on a larger scale of Chinese products, which, at times, did not meet the quality characteristics to meet the demand of the most common economic segments in Latin America.

• Similarly, the controls segment showed sustained growth, confirming a trend of a market well prepared technically and eager to implement high-performance solutions.

•In terms of industrial refrigeration, growth in 2006 was higher than expected, and the main investments, at least in the Andean Region, were driven by supermarkets, milk processors, air conditioning, industrial refrigeration with ammonia and commercial refrigerators.

•For the refrigeration compressor segment there was growth in all Latin countries.

Market maturity

The Latin American market presents enormous contrasts. Undoubtedly, the region has made progress in terms of the acceptance of new technologies, but there is still a long way to go in terms of the training of technicians and engineers. For most companies, this condition is positive, as it represents many business opportunities.

Based on the above, Latin America is still an emerging market that presents several dualities ranging from some nations with advanced capabilities to adopt new technologies, but there is a mole related to the maintenance of solutions and follow-up after the sale.

For other companies, the regional market is able to use any type of solution, as is the case with industrialized nations.

Market trends

To describe the Latin American market, both positive and negative aspects must be specified. Perhaps the only negative is that during 2006, and even yet, there was a very price-oriented market and this factor was decisive when buying. However, and here begins the positive, this trend has been able to be counteracted thanks to the quality and support that recognized brands have been offering. This situation was exposed by Martín Bertini, marketing supervisor of Heatcraft of Brazil.

In the refrigerant segment, as commented by Marco Antonio García of Honeywell, the market tilted in 2006 towards the regularization of the supply of 134a, while in some nations the production of R-12 was eliminated and the plants that were dedicated to the production of this compound were readjusted to produce R-22. The supply of Asian gases also increased.

In the controls segment, 2006 was a crucial year for the region, in which the highlight was a greater concern and interest of the industry to achieve greater energy efficiencies. In this segment, a market was more inclined to acquire high-performance solutions that lead to a reduction in electricity consumption. Tatiana Bertolini, of Full Gauge, and César Delgado, of Honeywell, coincided in this description.

This condition is somewhat supported by Mauro Gomes, from Bitzer, when he explained that during 2006 the market reflected a clear trend towards greater efficiency and towards the acquisition of equipment with low energy consumption, mainly in low and medium temperature evaporation systems.

What is true and clear is that Latin America has been improving markedly compared to other regions and other times. Today, the region is growing as a market on par with Asia as a technology provider.

Particularities of each country

While many of the countries in Latin America share similarities, it could be said that in the HVAC/R segment they also have their differences, especially in terms of technological advancement. The reasons for this are explained by the fact that the economic processes in these nations have been very dissimilar; many have already taken the first step to start producing technologically and then proceed to exports. Below are some very specific facts about the different segments presented in this analysis, in each of the countries of the region.

Brazil

In terms of air conditioning and refrigeration, it could be said that the Brazilian market is a little ahead of its Latin counterparts, since it is a nation that has a strong economy that in its processes involves significant amounts of cold. In addition to the above, an important group of local companies has been making remarkable efforts to export and join the Latino economic dynamics.

The field of evaporators and condensers for refrigeration systems was one of those that introduced a greater number of new actors. According to Bertini, in this segment, in Brazil, there was strong competition from the big brands, and some national minor brands gained good market share thanks to a strategy of low prices.

In the refrigerant segment, 2006 represented for this nation the last stage of the CFC phase-out program and the elimination of imports as of January 1, 2007, according to Marco Antonio García, of Honeywell.

This is in line with facts such as changes towards alternative fuels and the development of energy saving systems, as explained by César Delgado, from the same company, but from the controls division.

Mexico

The Aztec nation had a very positive year in 2006 for the CVAC/R industry. Several elements contributed to the above, and among them were the increase in crude oil prices (although this country is not a member of OPEC, it does have important figures in terms of oil production) and the good moment that construction has been presenting. n and private investment.

Mexico is definitely the Latin American benchmark and is positioned as a great buyer of technology for CVAC/R. But what did those who responded to the AC/R LATINOAMÉRICA survey say?

Although there were not many comments, since not all the participating companies do business in Mexico, what is clearly observed are some trends that are outlined below.

In the refrigerant segment, 2006 marked for the Aztec nation a period of great efforts to replace CFC-12, which included numerous government attempts to train technicians in the handling of these substances, their recovery and disposal in suitable containers. Additionally, an industrial reconversion program was carried out, so that interested users could replace old equipment with newer and more energy-efficient ones.

According to Marco Antonio García, another element that stood out in that period was the market's interest in knowing more substitutes for R-22.

This concern for the environment was also highlighted by César Delgado, who also mentioned the interest that was seen in this market, during 2006, for the development of energy saving systems.

Chile

This nation has several peculiarities, which make it in itself a very interesting market for the CVAC/R segment. On the one hand, it has a strong food industry that made it a territory dominated by industrial refrigeration from the most recognized companies of the old continent. Cooling with freons has also found its niche.

According to Martín Bertini, what this market showed in 2006 was the emergence of local manufacturers, as well as the entry of Chinese solutions. The market is going through a process of change and this has led buyers to lean towards the reliability of recognized brands.

Another important factor, and which confirms in some way the impact of the European tradition in this South American nation, is the concern for the environment, a fact highlighted by César Delgado.

Argentina

This nation is one of the most complex cases. Its strong food industry, as a positive aspect, and its economic volatility of the market, as a negative element, make any attempt to describe such a market difficult. However, it was one of the countries with record growth in 2006, something that was reflected in an interesting demand for solutions from the CVAC/R industry.

The segment of evaporators and condensers for commercial refrigeration saw in this market a remarkable strength of local manufacturing companies, although with low quality products. However, this does not take away from the competitiveness of the market; as a positive aspect, Bertini highlighted the openness towards imported brands of greater reliability.

In the case of refrigerants, the highlights during 2006 were the increasingly noticeable increase in solutions from China, while the negative could be some uncertainty regarding the production plans of a local fluorocarbonate producing plant.

In contrast, César Delgado highlighted two positive elements in this market: the growing concern for the environment and the increasingly common implementation of energy control systems.

Venezuela

This nation is definitely the great beneficiary of the increase in the prices of raw materials, more specifically oil, as this has allowed it to maintain high cash flows that have facilitated the purchase of large amounts of technology. In the field of air conditioning and refrigeration, as with other industrial segments, there is not much local production and in most cases it is preferred to import the technology that in some cases could be manufactured in-house.

Martín Bertini described the Venezuelan market as a major buyer of technology manufactured by well-known international brands.

Marco García highlighted how during 2006 the transition began in one of the CFC production plants in this country to go on to produce HCFC-22.

Colombia

For some years now, this nation in northern South America has been presenting stable growth, which without being among the highest regional growths at least maintains relative stability.

Economic growth has been reflected mainly in the construction sector, which has been developing notable commercial and residential projects for several years. Similarly, during 2006, and even the trend persists, an increase in domestic demand for consumer goods and items in the family basket was observed.

The macroeconomic policy of this nation is clearly oriented to free trade, proof of this is the simultaneous participation in several negotiations of this type, an aspect that could be positive for the field of refrigeration, as long as there is talk of exporting products and services that require this technique. The emergence of increased government awareness of the importance of cold processes is also an encouraging factor.

In the case of Heatcraft from Brazil, the perception they have about Colombia is of a market in which they face strong local competition, but this competitor is in clear decline. According to Bertini, imported products have been gaining more and more ground.

Honeywell's refrigerants division highlighted a greater entry of Asian products in the aftermarket segment (spare parts) in that nation during 2006.

Regarding controls, Delgado, from Honeywell, highlighted how this market reactivated processes and automation during 2006, thanks to the development of important projects.

According to Fernando Becerra, of Danfoss, what was seen in the period in question, in that market, was a growth in investment in air conditioning, thanks to the increase in construction projects; similarly, greater investment was observed in large areas (super and hypermarkets), as well as in very specific sectors such as tanks for the improvement of milk quality, investments in industrial refrigeration in the food and beverage segment (including breweries), as well as greater development in air conditioning for transport systems; the same happened with refrigerated transport systems.

Peru

During 2006, this nation was one of the countries with the highest growth in gdp, according to figures presented by ECLAC. With regard to CVAC/R, this country has been justifying the growth in terms of construction; many international companies are carrying out interesting corporate projects involving an advanced degree of automation in air conditioning. At the same time, the fishing and food industry in general is making significant progress and development, especially with regard to the industrial part.

In this market a good penetration of foreign technology is seen, so customers have at their disposal all kinds of offers of different quality; the price market was very strong during 2006, but such a situation did not impact the sales of the big players, according to Martín Bertini.

In addition to the above, there was the penetration of oriental products for the aftermarket segment, as happened in Colombia, an element highlighted by Marco Antonio García.

César Delgado, for his part, highlighted the implementation of energy control systems and that there was a greater concern for the environment in 2006 in Peru.

Central America

The Central American market has been developing its applications in air conditioning and refrigeration, as it is a region over which Mexico exerts a great influence. Additionally, there is a presence of large distributors of the most important brands in the world, which means that there is always technological availability in that region.

Panama has been in full construction expansion for some years, which includes the development of high-profile real estate projects, which obviously implies advanced control systems. This has significantly boosted the consumption of air conditioning systems on the isthmus; In Costa Rica the situation does not differ substantially from Panama, and recently, in the tourist area there have been many high-profile hotel and condominium developments, a situation that is favoring project developers and equipment distributors.

The other countries (Guatemala, Honduras and Nicaragua) have been working the refrigeration part, since the entry into force of the free trade agreement between Central America and the Dominican Republic with the United States poses interesting challenges for those who depend on the cold chain to export.

Facts highlighted by those who responded to the survey of this medium were the increasing penetration of oriental products for the aftermarket segment, this in regard to the refrigerant segment, and a greater development of control systems and a growing concern for the environment, in terms of control systems.

Overall, the Latino market for components for CVAC/R systems can be said to have grown during 2006. The reasons were very variable, but below are highlights that could impact demand in the sectors consulted:

•For Heatcraft of Brazil, the reason for the growth of the South American market during 2006 was the good economic moment that the countries of that subregion went through.

•Growth in the refrigerant segment was mainly driven by the anticipated replacement of R-12 in Brazil and Mexico.

•In the field of controls, the growth was related to a greater offer of cutting-edge technology, and at this point Full Gauge and Honeywell coincided.

•In Colombia, growth in the field of compressors was regulated by better economic and safety conditions that have been implemented and promoted by the current government.

BOX 1

More help from governments is needed to boost business growth

One of the elements that emerge from any market research in Latin America in general is that economics and politics are still highly interdependent. Although this situation was somewhat controlled during 2006, the truth is that the role of governments is still decisive for the fluidity that business can have.

For Brazil's Heatcraft, there is still a lot of help from governments to let business flow freely. This adds to the fact that state control mechanisms are weak.

Some important facts highlighted by Martín Bertini were:

•Supermarkets and refrigerators had strong growth in South America during 2006.

Brazil continues to lead the ranks of technology producers in the subregion.

•The most demanded products for this company were remote condensers, condensing units, evaporators and rack systems.

•Price was the determining factor during 2006, but quality is still a factor that demands attention from the buyer. Marketing is based on courses and training and advertising in specialized media.

•The responsibility and compliance of local manufacturers is still at a disadvantage compared to large international brands.

• Applications with Freon are growing against ammonia in cases where there is the possibility of applying both technologies.

BOX 2

International standards, a determining factor for the refrigerant segment

Given the orientation of the region to price, large international companies have to look for new strategies to be able to market the products, especially if one takes into account the avalanche of products from China. Therefore, companies with high global recognition chose to make their adjustment to international laws on environmental protection, the workhorse to over-exit in a highly competitive market.

Marco Antonio García also highlighted the following facts:

•The fastest growing refrigerant user segments in Latin America were original equipment producers (OEMs), mainly automotive and domestic applications.

• Exports to the United States and Europe are the factor that has most driven the technological upgrade in the OEM segment.

•The gases that were most demanded in the region during 2006 were: R-134a; R-22, R-404A, R-409A, R-401A, R-410A, R-507, R-407C among others.

•The regulations for importing refrigerants into Latin America are in most cases subject to international regulations.

This means that although in some cases import is slow, the end user and the environment find a refrigerant market almost entirely responsible.

Local producers (Argentina) of refrigerants have a limited supply of products, focusing on R-12 and R-22.

BOX 3

Greater dynamism in cooling

Traditionally, the CVAC/R industry was driven by the air conditioning and industrial ventilation segment. In recent years, and this was the case in 2006, the application of refrigeration for various economic sectors has been presenting a better performance, to be parallel to its sister of air conditioning.

Within the refrigeration not only was movement seen in the commercial part, but the industrial one is also advancing in an important way.

Other 2006 trends highlighted by Full Gauge were:

•The most demanded solutions for this company were digital instruments for the control of de-icing in chambers and refrigerated showcases, instruments for cooling chambers, energy monitors and management software for commercial and industrial refrigeration facilities.

•During 2006 some businesses were compromised due to Brazilian government bureaucracies; however, the signing of trade agreements between Brazil and other nations of the planet is expected to be a determining factor in boosting exports.

BOX 4

Hotels, energized segment of controls

For a couple of years now, there has been talk of the construction boom in Latin America. According to experts in conversations with this media, the truth is that what is being presented is a development in the commercial sector (within this hotels), not so much in the residential. This was confirmed by César Delgado in relation to the segments that have energized the controls segment.

Simultaneously, this professional highlighted other trends in the Latin market during 2006:

•Mexico was a major exporter of controls technology. It was perhaps the Latin country with the greatest strength in this segment.

•Many companies tried to enter the market during 2006 and tried to gain commercial share based on prices. Such companies do not stay long in the market, but they do leave their mark on the consumer price index.

•The lack of uniformity in countries' trade laws leads to confusion and interpretations in this regard; it is also costly to start operations in some countries.

BOX 5

Latin America, a market that assimilates technology

One of the elements highlighted by Fernando Becerra, of Danfoss, is the characteristic of the Latin market, which in his opinion, beyond seeking to be a manufacturer or technological producer, must work on the use of the developments that occur in developed nations. In this case, it seems that the region has fully adopted this role and is assimilating this technology without major difficulties.

And it seems that for first world companies, earning a reputation as a reliable supplier is the best marketing strategy in a market as diverse as Latin America.

But beyond that, Becerra highlighted a couple of additional elements:

•The economic segments that are driving the purchase of compressors in Colombia are: construction, transportation and food infrastructure.

•The most demanded solutions in this market are: domestic, semi-hermetic and air conditioning compressors, expansion valves and filters, among others.

• Colombia is a market clearly open to trade, a situation different from that observed in nations such as Cuba, Venezuela and Brazil where there are still signs of protectionism.

BOX 6

Technological development focused on the region

There are many and varied commercial strategies that can be implemented in Latin America, but perhaps one of the most effective could be the development of technology based on the particularities and needs of each country, put into operation by Bitzer, to which they have added speed in delivery, reliability and constant training to gain a foothold in the region's market.

According to Mauro Gomes, in Latin America there is a strong demand for refrigeration systems in almost the entire food industry, which include cold rooms, supermarkets, freezing tunnels and refrigerated transport, among others.

Other aspects that Gomes highlighted were:

•The air conditioning industry suffers from greater competition with Asian products, mainly in split systems, but there are still several manufacturers of chillers and self-type systems.

•The most demanded products of this brand during 2006 were: reciprocating semi-hermetic compressors and screws, as well as condensing units.

• The degree of government support for free trade has also improved, but it depends on the particularity of each country. There is no uniformity and there are still excessive bureaucratic rules in some sectors.